Best CRM for Investment Bankers: As the financial world evolves, having the right CRM system tailored for investment bankers is crucial. Explore the key features, customization options, data security measures, and workflow efficiencies that can make a significant impact on productivity and client relationships.

Overview of CRM for Investment Bankers: Best Crm For Investment Bankers

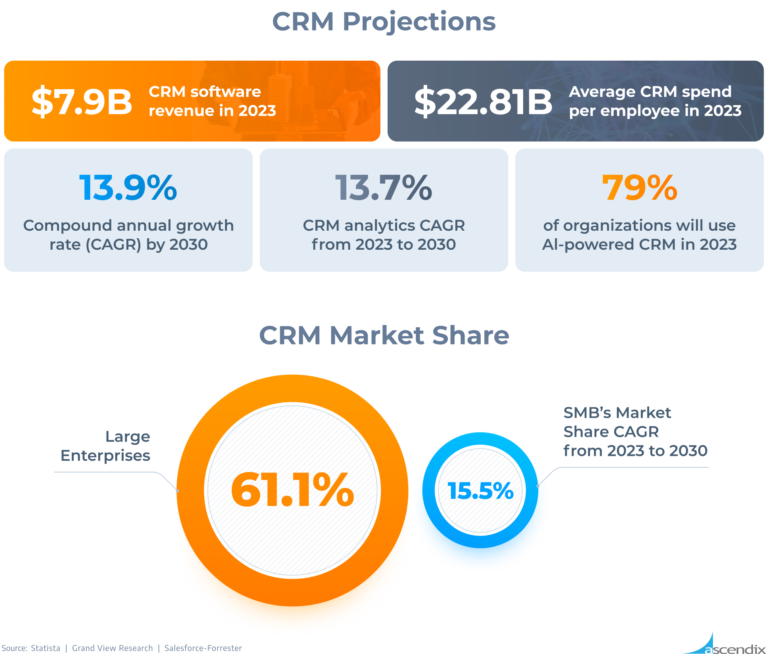

Customer Relationship Management (CRM) systems play a crucial role in the daily operations of investment bankers. These software solutions are designed to help manage client relationships, track interactions, and streamline processes to improve efficiency and productivity.

Importance of CRM Systems

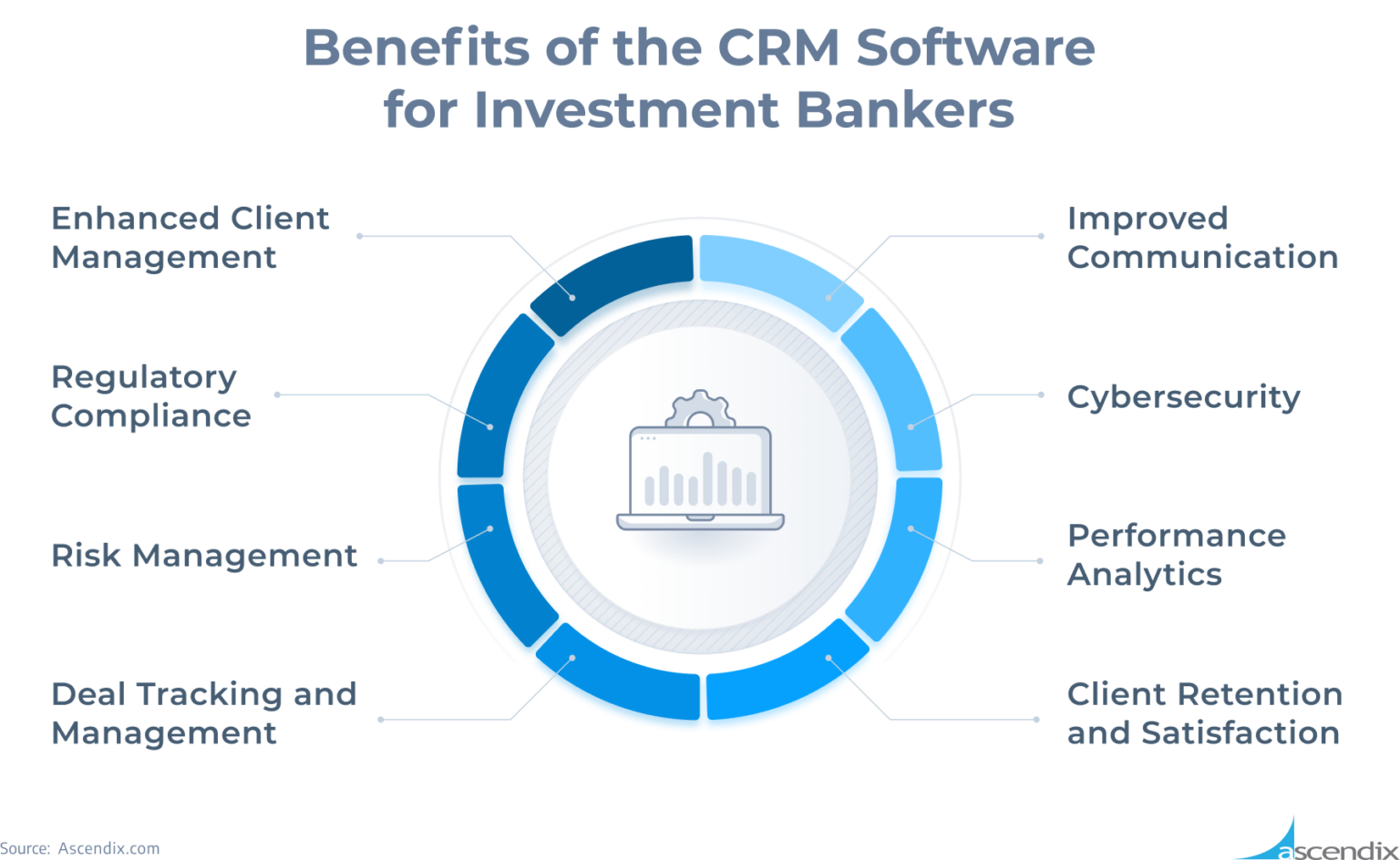

CRM systems are essential for investment bankers as they provide a centralized platform to store client data, track communication history, and manage deals effectively. By utilizing CRM systems, investment bankers can enhance client relationships, identify opportunities, and make informed decisions based on data-driven insights.

Key Features to Look For

Investment bankers should look for CRM systems that offer robust contact management, pipeline tracking, reporting capabilities, and integration with other tools such as email platforms and financial databases. Customization options, scalability, and ease of use are also important factors to consider when selecting a CRM solution.

Comparison of CRM Options

There are several CRM options available in the market specifically tailored for investment bankers, such as Salesforce, Microsoft Dynamics 365, and Zoho CRM. Each platform offers unique features and functionalities to cater to the specific needs of investment banking professionals.

Customization and Integration

Customization plays a vital role in ensuring that CRM systems meet the unique requirements of investment bankers. By customizing fields, workflows, and reporting dashboards, investment bankers can tailor the CRM to align with their business processes and objectives.

Integration with Existing Tools

CRM systems can be integrated with existing tools used by investment bankers, such as email clients, financial analysis software, and communication platforms. Seamless integration allows for data synchronization, automation of tasks, and enhanced collaboration among team members.

Benefits of Integration, Best crm for investment bankers

The seamless integration between CRM and other platforms enables investment bankers to access real-time data, streamline processes, and improve decision-making. By centralizing information and automating workflows, integration enhances efficiency and productivity in managing client relationships and deals.

Data Security and Compliance

Data security is of utmost importance in CRM systems for investment bankers to protect sensitive client information and maintain regulatory compliance. CRM solutions must adhere to strict security protocols, encryption standards, and data privacy regulations to prevent unauthorized access and data breaches.

Compliance Requirements

CRM solutions need to meet compliance requirements such as GDPR, FINRA, and SEC regulations to ensure data protection and confidentiality for investment banking transactions. Compliance with industry standards and regulations is essential to maintain trust with clients and regulatory authorities.

Implications of Data Breaches

Data breaches in the context of investment banking can have severe consequences, including financial losses, reputational damage, and legal implications. Investment bankers must prioritize data security measures and implement robust protocols to mitigate the risks associated with potential breaches.

Automation and Workflow Efficiency

Automation features in CRM systems can significantly improve workflow efficiency for investment bankers by reducing manual tasks, streamlining processes, and increasing productivity.

Streamlining Processes

CRM automation can optimize workflows such as lead scoring, email marketing campaigns, client onboarding, and deal tracking. By automating repetitive tasks, investment bankers can focus on high-value activities that drive business growth and enhance client satisfaction.

Impact on Productivity

Improved workflow efficiency through CRM automation leads to increased productivity, faster deal closures, and better client engagement. By utilizing automation features, investment bankers can save time, eliminate errors, and deliver personalized services to clients, ultimately driving success in the competitive investment banking industry.

Final Review

In conclusion, choosing the best CRM for investment bankers is not just about technology – it’s about enhancing relationships and maximizing efficiency in a competitive industry. With the right CRM solution, financial success is within reach.

Quick FAQs

What are some key features investment bankers should look for in a CRM?

Investment bankers should prioritize features like deal tracking, client management, reporting tools, and integration capabilities when choosing a CRM.

How important is data security in CRM systems for investment bankers?

Data security is paramount for investment bankers as it involves sensitive financial information. Look for CRMs with robust security measures and compliance standards.

Can CRM automation benefit investment bankers?

CRM automation can greatly benefit investment bankers by streamlining processes, optimizing workflows, and boosting overall productivity.