Best CRM for insurance agency introduces a powerful tool that revolutionizes how insurance agencies operate, focusing on efficiency and customer satisfaction. As we delve into the world of CRM software tailored for insurance agencies, we uncover essential features and benefits that can elevate your business to new heights.

Exploring the factors to consider when selecting the ideal CRM solution, we navigate through key considerations like scalability, customization, and data security. Additionally, real-world case studies shed light on successful CRM implementations, showcasing tangible benefits such as increased productivity and enhanced customer relationships.

Overview of CRM for Insurance Agencies

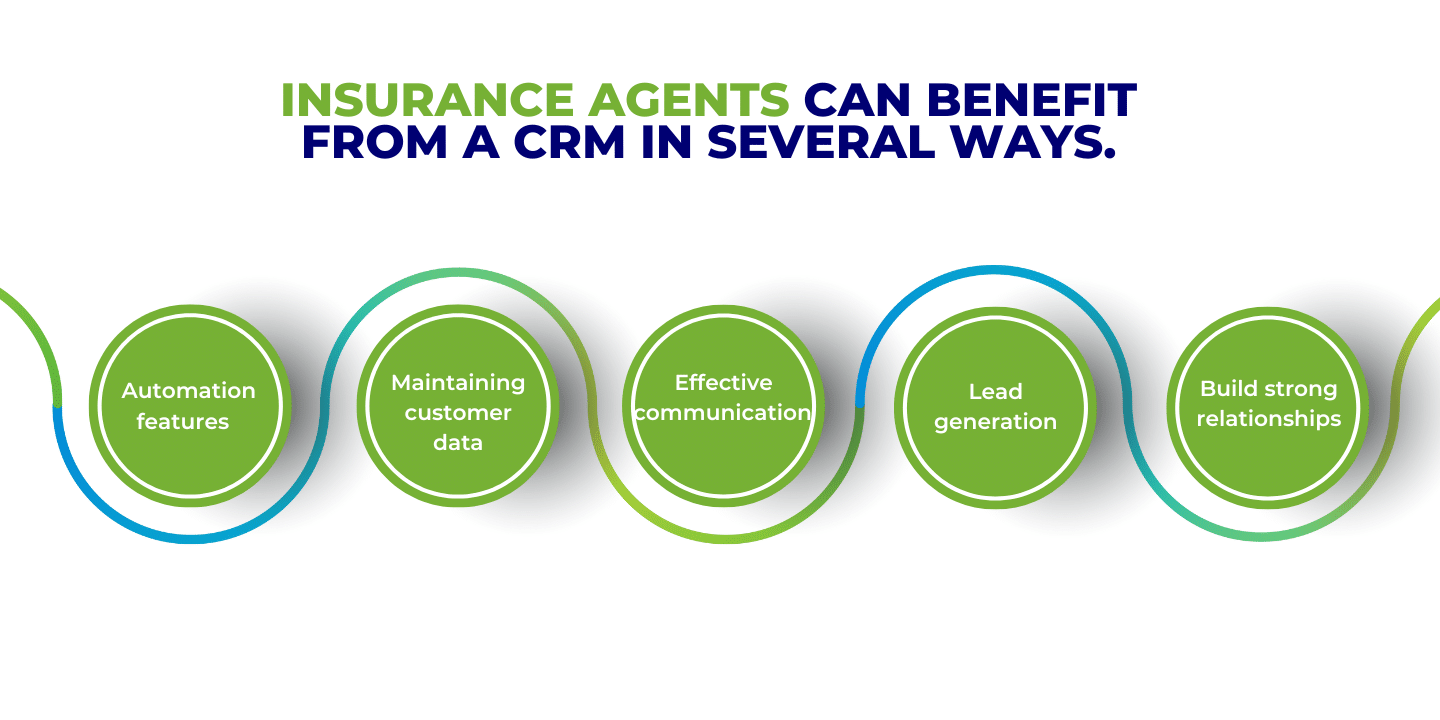

Customer Relationship Management (CRM) is a crucial system for insurance agencies to manage interactions with clients and potential customers. CRM software helps insurance agencies track, analyze, and improve customer relationships, leading to increased sales and customer satisfaction. The best CRM for insurance agencies should have features tailored to the specific needs of the industry, such as lead management, policy tracking, and automated communication tools.

Key Features of the Best CRM for Insurance Agencies

- Lead management to track potential customers and streamline the sales process

- Policy tracking to monitor policy details, expiration dates, and renewals

- Automated communication tools for personalized messaging and follow-ups

- Integration capabilities with other tools and software used by insurance agencies

- Data security measures to protect sensitive customer information

Factors to Consider When Choosing a CRM for Insurance Agencies

When selecting a CRM for insurance agencies, it is essential to consider factors such as scalability, customization options, and integration capabilities. The CRM should address the specific needs of insurance agencies, including compliance with industry regulations and data security measures. Comparing different CRM options based on these factors will help insurance agencies choose the most suitable solution for their business.

Data Security and Compliance, Best crm for insurance agency

- Ensure the CRM complies with industry regulations such as HIPAA for handling sensitive customer data

- Implement data security measures to protect customer information from cyber threats

- Regularly update and monitor the CRM system to maintain compliance and security

Case Studies of Successful Implementation

Insurance agencies that have successfully integrated CRM systems have reported increased productivity, improved customer satisfaction, and higher retention rates. By leveraging CRM software, these agencies were able to streamline processes, personalize customer interactions, and track key metrics to drive business growth.

Measurable Benefits of CRM Implementation

- Increased productivity through automation of repetitive tasks

- Improved customer satisfaction with personalized communication and efficient service

- Higher retention rates due to targeted marketing and customer engagement

Integration with Other Tools and Software

CRM integration with tools like email marketing platforms, accounting software, and customer service solutions can streamline processes and improve overall efficiency for insurance agencies. Seamless integration allows data to flow seamlessly between systems, reducing manual work and ensuring data consistency across platforms.

Popular Integrations for Insurance Agencies

- Email marketing platforms for targeted communication and lead nurturing

- Accounting software for streamlined financial management and reporting

- Customer service solutions for centralized customer support and issue resolution

Final Conclusion: Best Crm For Insurance Agency

In conclusion, the best CRM for insurance agency is a vital tool in today’s competitive landscape, offering seamless integration with various platforms to optimize operations and drive growth. By prioritizing customer relationships and operational efficiency, insurance agencies can unlock their full potential and thrive in a rapidly evolving industry.

Q&A

What specific features should the best CRM for insurance agency have?

The best CRM for insurance agencies should include features like lead management, policy tracking, automated workflows, and robust reporting capabilities.

How important is data security when choosing a CRM for insurance agencies?

Data security is paramount for insurance agencies due to the sensitive nature of client information. It’s crucial to select a CRM that offers robust security measures and compliance with industry regulations.

Can CRM software integrate with other tools like email marketing platforms?

Yes, the best CRM for insurance agencies should seamlessly integrate with tools like email marketing platforms to enhance communication and streamline marketing efforts.