Best CRM for insurance agencies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

CRM systems play a vital role in the insurance sector, revolutionizing how agencies manage relationships, streamline processes, and ensure compliance. In this comprehensive guide, we will explore the key features, customization options, security considerations, and user-friendly interfaces that define the best CRM solutions tailored for insurance agencies.

The Importance of CRM for Insurance Agencies

CRM systems play a crucial role in the success of insurance agencies by providing a centralized platform for managing customer relationships, policies, and claims. These systems help agents track leads, monitor client interactions, and streamline communication, leading to improved customer satisfaction and retention.

Explain why CRM systems are crucial for insurance agencies.

- Enhanced customer relationships through personalized interactions.

- Improved efficiency in managing policies and claims.

- Better insights into customer needs and preferences.

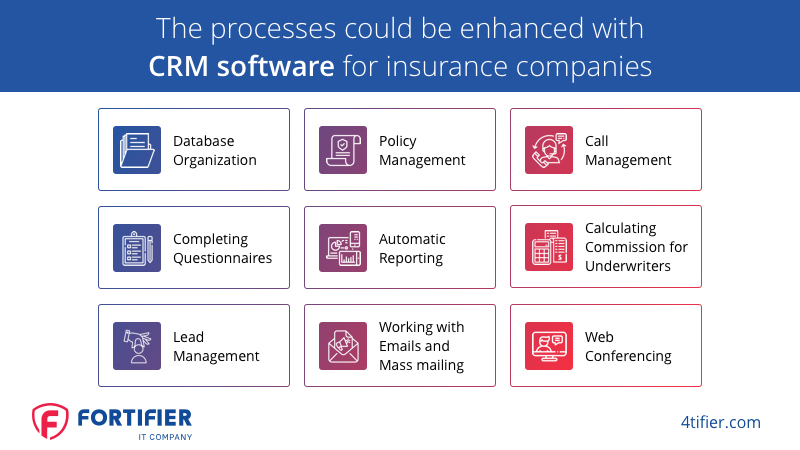

Discuss how CRM software can streamline processes for insurance agents.

- Automation of repetitive tasks such as data entry and follow-ups.

- Integration with other tools like email and calendar for seamless workflow.

- Access to real-time data for quick decision-making.

Identify key benefits of using CRM specifically tailored for insurance agencies.

- Customized dashboards for tracking policy renewals and claims status.

- Compliance with industry regulations for data protection and privacy.

- Scalability to accommodate growth and evolving business needs.

Features to Look for in CRM Software for Insurance Agencies

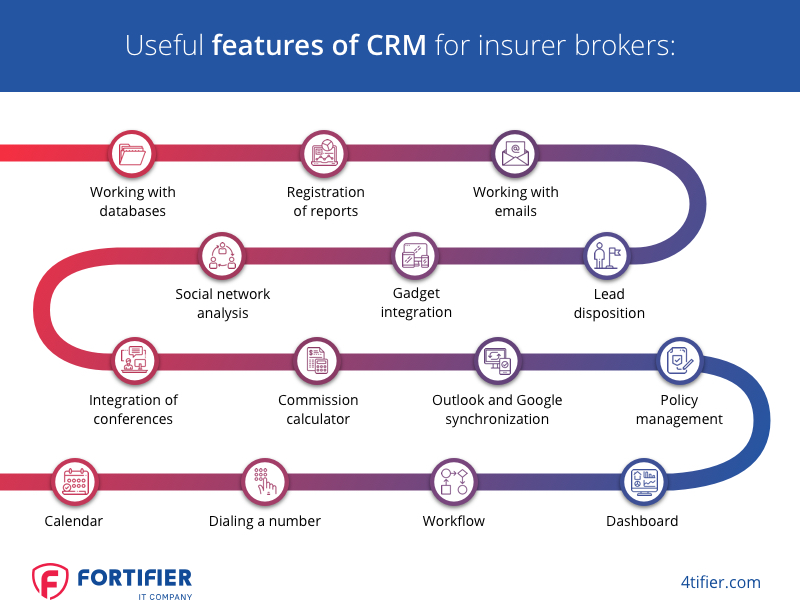

When choosing CRM software for insurance agencies, it’s essential to consider specific features that cater to the unique needs of the industry. These features can enhance productivity, streamline processes, and improve overall efficiency for agents.

List essential features that are must-haves for CRM systems in the insurance sector.

- Policy management tools for tracking and updating client policies.

- Claims processing capabilities to streamline the claims approval process.

- Integration with third-party data sources for comprehensive customer profiles.

Compare different CRM software options and highlight their key features.

- CRM A: Offers seamless integration with popular insurance carriers for real-time quote generation.

- CRM B: Provides customizable reporting tools to track agent performance and customer satisfaction.

- CRM C: Includes automated lead scoring and routing features for efficient lead management.

Provide examples of how specific features can enhance productivity for insurance agents.

- Automated email reminders for policy renewals to reduce manual follow-ups.

- Mobile access for agents to update client information on the go.

- Workflow automation for claims processing to expedite approvals.

- Custom fields and layouts to tailor the CRM system to the agency’s unique processes.

- Workflow automation customization for personalized customer interactions.

- Role-based access control to restrict data visibility based on user roles.

- Integration with email platforms for easy communication with clients.

- Syncing with accounting software for streamlined invoicing and payment tracking.

- Compatibility with mobile apps for access to CRM data on-the-go.

- Customized reporting templates for generating client-specific policy summaries.

- Integration with electronic signature tools for quick policy approvals.

- Automated data syncing with third-party systems to avoid manual data entry errors.

- Encryption of data in transit and at rest to prevent unauthorized access.

- Role-based access control to limit data exposure based on user roles.

- Regular security audits and updates to address vulnerabilities and threats.

- Adherence to HIPAA regulations for handling protected health information.

- Compliance with GDPR guidelines for data privacy and consent management.

- Integration with compliance monitoring tools to track adherence to industry regulations.

- Two-factor authentication for secure user access to the CRM system.

- Audit trails to track changes to sensitive data and ensure accountability.

- Data encryption for secure transmission of client information over the network.

- Intuitive navigation for easy access to client information and policy details.

- Customizable dashboards to display key metrics and performance indicators.

- Drag-and-drop functionality for quick data entry and updates.

- Onboarding training sessions to familiarize agents with the CRM system’s features.

- Ongoing support for troubleshooting technical issues and answering user queries.

- Online resources and tutorials for self-paced learning and skill development.

- Interactive tutorials with step-by-step guides for common tasks like lead management.

- Virtual training sessions with live demonstrations and Q&A sessions for real-time learning.

- Knowledge base with FAQs and best practices for efficient CRM usage and optimization.

Customization and Integration Capabilities

Customization and integration capabilities are essential for CRM software used by insurance agencies to adapt to specific workflows and integrate seamlessly with existing tools. This flexibility can significantly improve efficiency and productivity for agents.

Discuss the importance of customization options in CRM software for insurance agencies.

Explain how seamless integration with existing tools can benefit insurance agents.

Provide examples of how customization and integration can improve workflow efficiency.

Security and Compliance Considerations

Security and compliance are paramount in the insurance industry, and CRM software must adhere to strict data protection regulations to ensure confidentiality and regulatory compliance. Robust security features are essential to safeguard sensitive customer information.

Detail the security measures that the best CRM software for insurance agencies should have.

Discuss the importance of compliance with industry regulations in CRM systems for insurance.

Provide examples of security features that ensure data protection and regulatory compliance.

User-Friendly Interface and Training Support: Best Crm For Insurance Agencies

A user-friendly interface and comprehensive training support are essential for insurance agents to maximize the benefits of CRM software. Intuitive design and ongoing training can help agents adapt quickly to the system and leverage its full capabilities.

Explain the significance of a user-friendly interface in CRM software for insurance professionals.

Discuss the role of training and support services in helping insurance agents maximize CRM usage., Best crm for insurance agencies

Provide examples of intuitive interfaces and effective training strategies in CRM solutions.

Epilogue

In conclusion, the best CRM for insurance agencies goes beyond just managing data; it empowers agents to deliver exceptional service, boost productivity, and stay compliant with regulations. By prioritizing efficiency, security, and user experience, insurance agencies can elevate their operations and build lasting client relationships.

General Inquiries

What makes CRM crucial for insurance agencies?

CRM systems help insurance agencies track customer interactions, manage policies effectively, and improve customer retention through personalized services.

How can CRM software benefit insurance agents?

CRM software streamlines processes, automates tasks, enhances communication, and provides valuable insights for agents to make informed decisions.

What security measures should the best CRM software for insurance agencies have?

The best CRM software for insurance agencies should have encryption capabilities, role-based access controls, regular security updates, and compliance with data protection regulations.

Why is a user-friendly interface important in CRM software for insurance professionals?

A user-friendly interface ensures that agents can navigate the CRM system efficiently, leading to increased adoption, productivity, and overall satisfaction with the software.

How does customization and integration enhance workflow efficiency in CRM software for insurance agencies?

Customization allows agencies to tailor the CRM system to their specific needs, while integration with existing tools ensures seamless data flow and improved collaboration among team members.