With best crm for banks at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. The selection of the right CRM software can make a significant impact on the efficiency and success of banking operations.

Factors to Consider When Choosing the Best CRM for Banks

When selecting a CRM system for a bank, several key factors need to be taken into consideration to ensure that the software meets the specific needs of the banking environment.

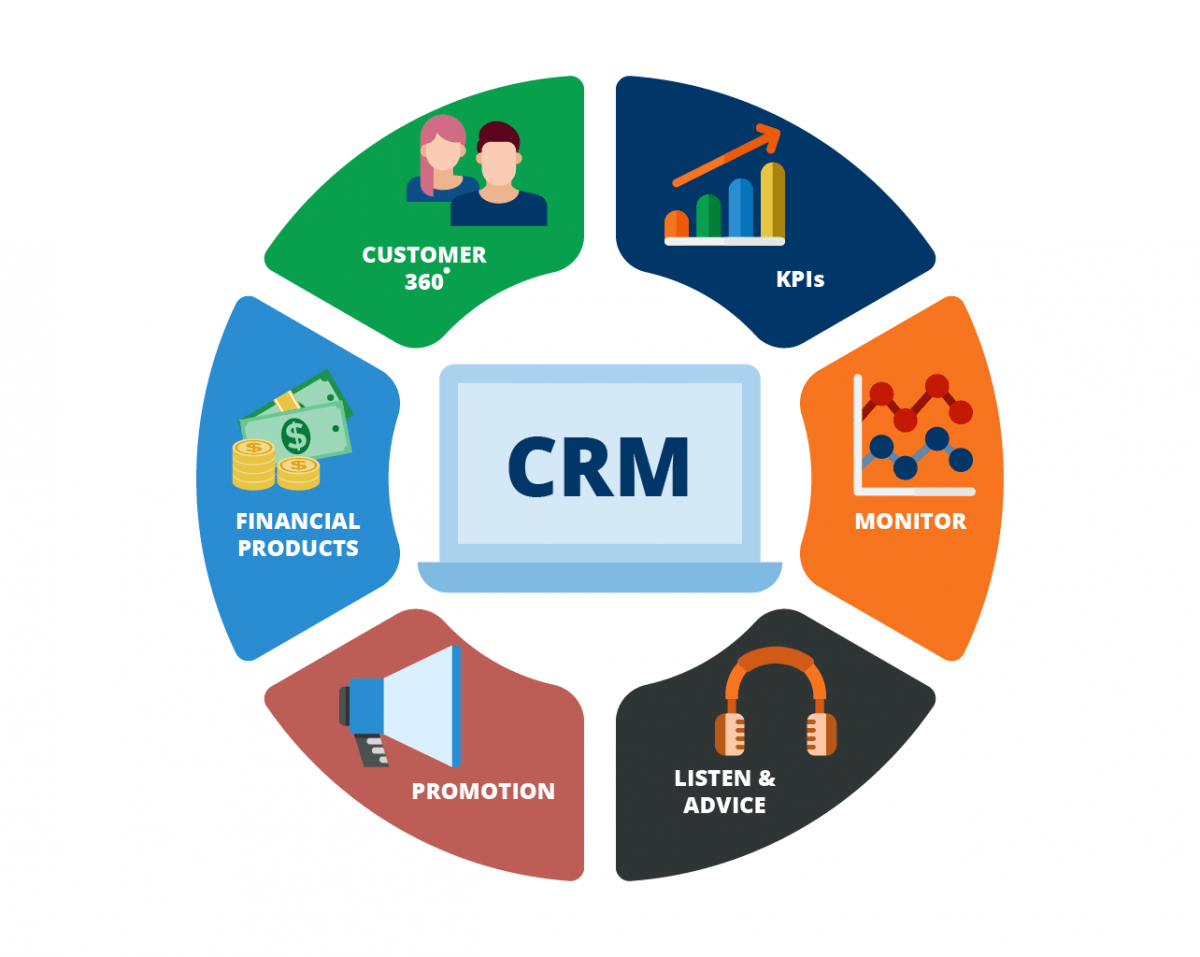

Key Features for a CRM in a Banking Environment

– Customer Data Management: The CRM should have robust capabilities for storing and managing customer information, transaction history, and interactions.

– Integration with Core Banking Systems: Seamless integration with core banking systems is crucial for real-time data updates and accuracy.

– Analytics and Reporting: Advanced analytics tools are essential for banks to gain insights into customer behavior, trends, and performance metrics.

– Compliance and Security: The CRM must comply with banking regulations and industry standards to ensure data security and privacy.

Importance of Scalability and Customization

– Scalability: The CRM should be able to grow with the bank’s needs, accommodating an increasing volume of customers and data.

– Customization: Banks have unique processes and workflows that require a CRM system that can be tailored to fit specific requirements.

Security Measures in a Banking Setting, Best crm for banks

– Data Encryption: The CRM should encrypt customer data to protect sensitive information from unauthorized access.

– Role-Based Access Control: Implementing role-based access control ensures that only authorized personnel can view or modify sensitive data.

– Audit Trails: Maintaining detailed audit trails helps track any changes made to customer data and ensures accountability.

Comparison of Top CRM Software Options for Banks

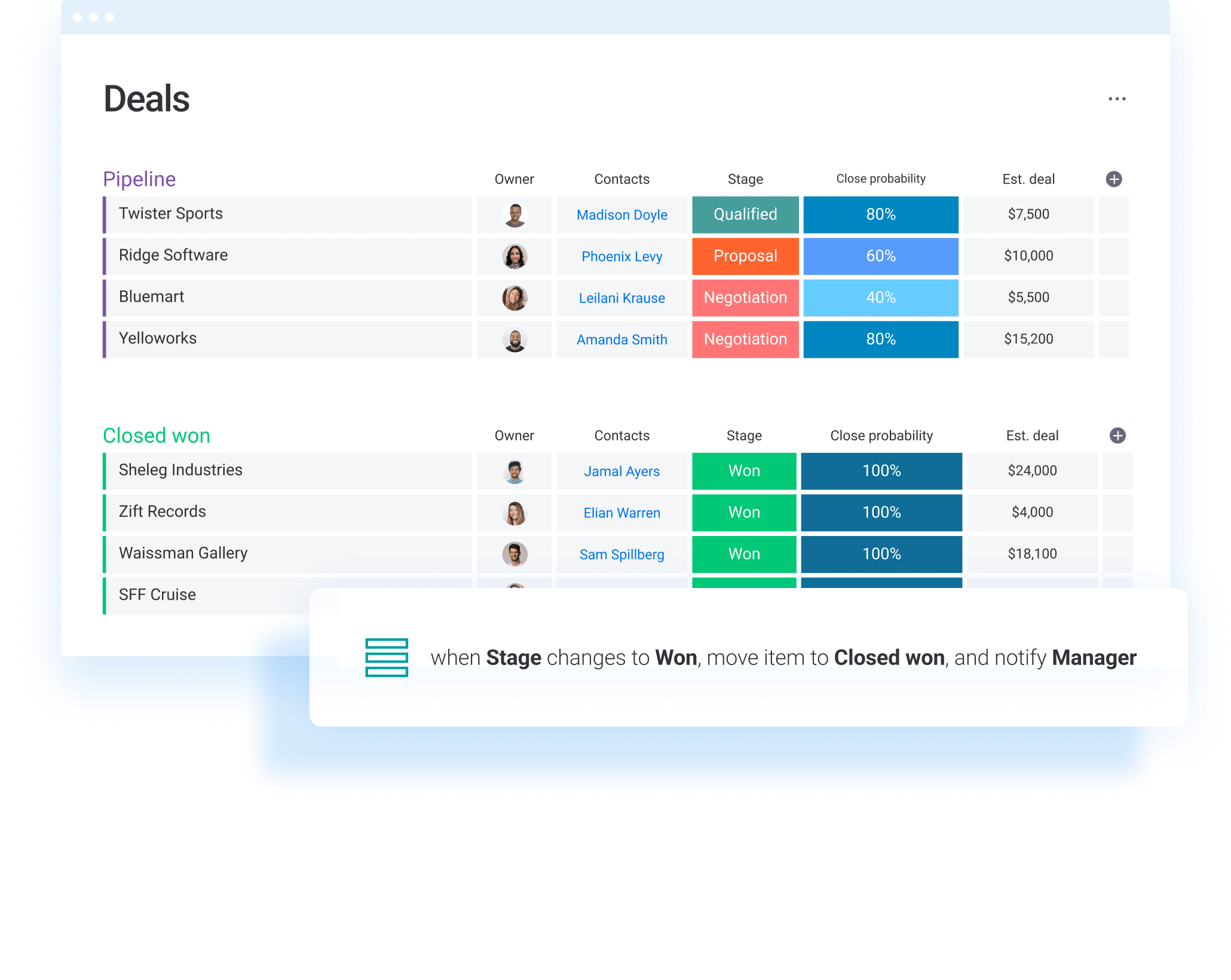

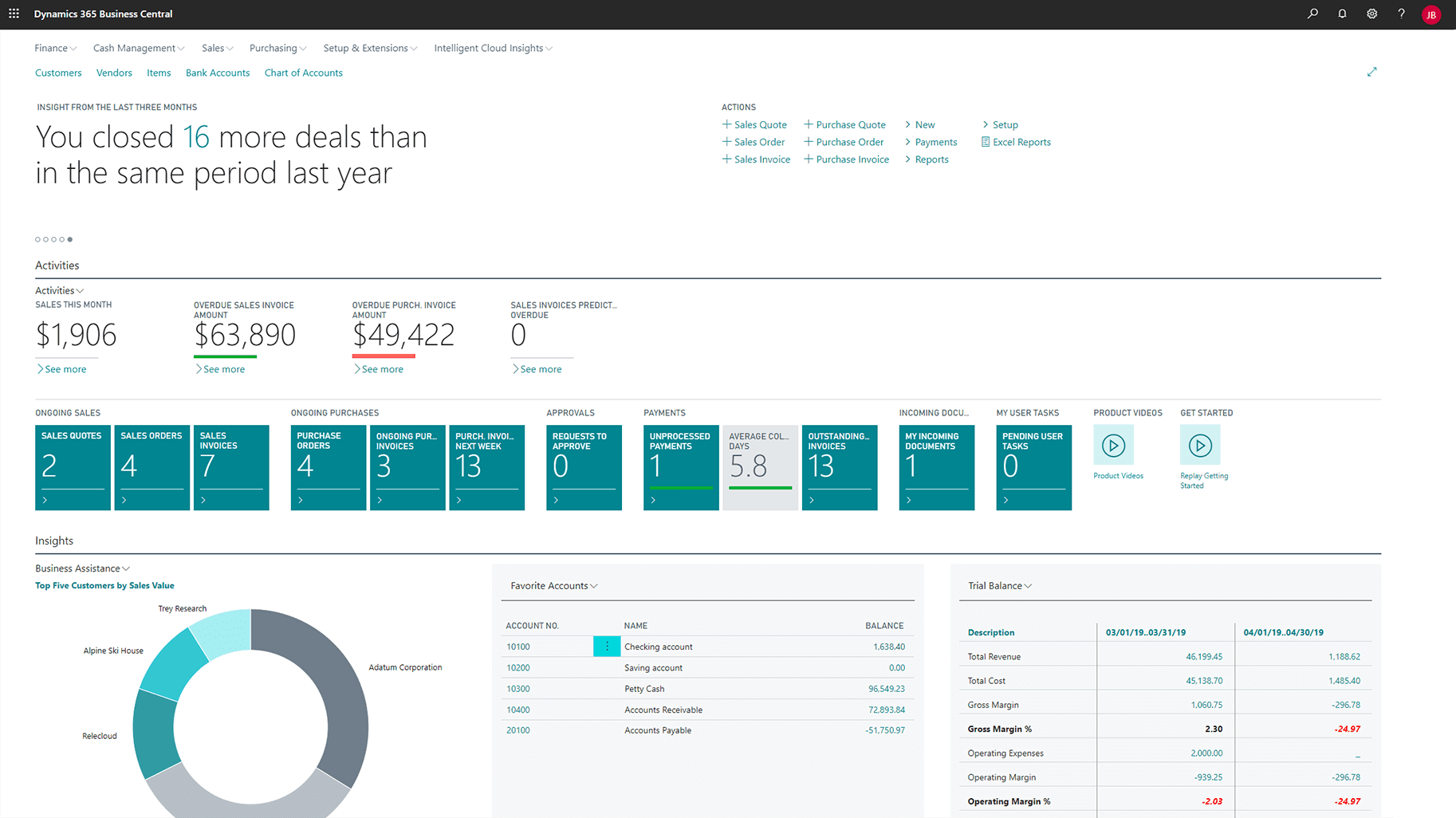

When comparing different CRM software options for banks, it is essential to evaluate their functionality, user interface, and integrations to determine the best fit for the organization.

Functionality

– CRM A: Offers advanced automation features for marketing campaigns and customer communication.

– CRM B: Focuses on analytics and reporting tools to provide in-depth insights into customer behavior and trends.

– CRM C: Provides seamless integration with third-party applications for enhanced customer experience.

User Interface and Ease of Use

– CRM A: Intuitive user interface with customizable dashboards for easy navigation.

– CRM B: Streamlined workflows and user-friendly design for quick adoption by bank employees.

– CRM C: Mobile-friendly interface for on-the-go access to customer information and data.

Integrations and Impact on Banking Operations

– CRM A: Integrates with popular banking software for a unified view of customer data and transactions.

– CRM B: Offers API integrations with third-party tools to enhance customer engagement and marketing efforts.

– CRM C: Integrates with social media platforms for targeted marketing campaigns and customer interaction.

Implementation Process for a CRM in a Bank

The implementation of a CRM system in a bank involves several steps to ensure a smooth transition and effective utilization of the software by bank staff.

Steps in Implementing a CRM System

– Conducting a Needs Assessment: Identifying the specific requirements and objectives of the bank to select the most suitable CRM solution.

– Customization and Configuration: Tailoring the CRM system to align with the bank’s processes and workflows for seamless integration.

– Training and Adoption: Providing comprehensive training to bank staff on using the CRM software effectively to maximize its benefits.

Data Migration and Transition

– Data Mapping: Mapping existing data from legacy systems to the new CRM platform to ensure data integrity and accuracy.

– Testing and Validation: Conducting thorough testing of the CRM system to validate data migration and functionality before going live.

– Post-Implementation Support: Offering ongoing support and maintenance to address any issues or concerns that may arise after the CRM system is implemented.

Case Studies of Successful CRM Implementations in Banks: Best Crm For Banks

Real-world examples of banks that have implemented CRM systems successfully demonstrate the benefits and challenges associated with integrating CRM software in a banking environment.

Successful CRM Implementations

– Bank X: Implemented CRM system resulted in a 20% increase in customer retention and a 15% growth in cross-selling opportunities.

– Bank Y: Overcame challenges in data migration and integration, leading to improved customer satisfaction and operational efficiency.

– Bank Z: Leveraged CRM analytics to optimize marketing campaigns and drive personalized customer interactions for enhanced loyalty and engagement.

Final Thoughts

In conclusion, the journey through the realm of CRM for banks unveils the critical factors to consider, the top software options available, the implementation process, and real-life success stories of banks leveraging CRM solutions. Implementing the best CRM can revolutionize how banks engage with customers and manage their operations efficiently.

FAQ Insights

What are the key features essential for a CRM in a banking environment?

Key features include robust security measures, scalability for growth, customization options tailored to banking needs, integration capabilities with existing systems, and analytics for customer insights.

How important is scalability and customization for banks when choosing a CRM?

Scalability ensures that the CRM can adapt to the bank’s growth and increasing data needs, while customization allows banks to tailor the CRM to specific workflows and processes.

What is involved in the implementation process of a CRM in a bank?

The implementation process includes system setup, data migration, staff training, integration with existing systems, testing, and ongoing support to ensure smooth operations.

Can you provide examples of successful CRM implementations in banks?

Examples include banks that saw improved customer service, streamlined operations, increased sales, and better data management after implementing CRM solutions.